What Payment Software Do Exporters Use in Foreign Trade?

If you’ve ever run a foreign trade business, you’ve probably asked yourself: “What’s the best way to collect payments from overseas clients?” At first glance, it may seem like just choosing a “software” or “app,” but in reality, export trade is a bit more complex.

Unlike domestic transactions, foreign trade payments involve multiple currencies, compliance checks, and international regulations. That’s why instead of relying only on simple software, most exporters turn to enterprise bank accounts—and one reliable option is CBiBank, a U.S.-based international commercial bank that helps SMEs manage cross-border payments with ease.

1. Why Exporters Need More Than Just Software

When people talk about “payment software” in foreign trade, they often think of tools like online wallets or third-party apps. While these can be convenient for personal transfers, they’re not always suitable for businesses dealing with export transactions. Here’s why:

🌍 Global currency support is often limited in small apps.

⚡ Transaction amounts in foreign trade are usually larger and require stronger safeguards.

🔒 Compliance and verification are critical to avoid frozen payments.

That’s why exporters prefer using enterprise accounts through international banks, which offer both the digital convenience of “software” and the reliability of formal financial infrastructure.

2. CBiBank: A Smarter Alternative for Export Payments

Instead of juggling multiple “payment software,” exporters can open an enterprise account with CBiBank. It functions like a central hub for all foreign trade payments, with features designed specifically for businesses:

Support for 20+ global currencies including USD, EUR, CNH, GBP, and JPY.

Cross-border e-commerce collections for platforms like Amazon, eBay, and Tmall Global.

Secure online banking with real-time monitoring and 24/7 bilingual customer support.

Fast account setup—all remote, usually within 1–3 days.

👉 You can explore the official application page here: CBiBank Enterprise Account.

3. Key Advantages Compared to Regular Software

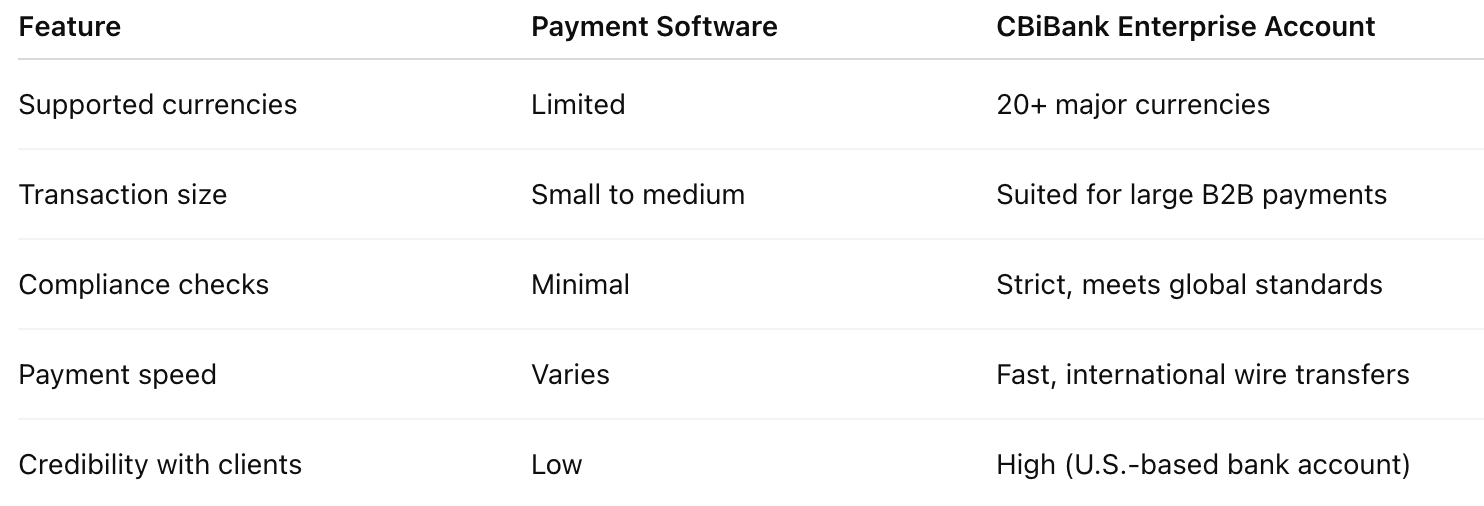

Here’s how an enterprise account like CBiBank’s stacks up against typical payment apps:

For exporters, these differences can make or break a deal. A buyer is far more likely to trust an invoice linked to a U.S. bank account than one asking to transfer to a random app.

4. How to Get Started with Export Payment Collections

Here’s a simple roadmap for businesses exploring better payment solutions:

Evaluate your market needs – Which regions are you selling to? Which currencies are most common?

Choose a bank with international coverage – Ensure it supports multiple currencies and export trade services.

Prepare your documents – Registration certificates, shareholder info, and proof of business.

Open an enterprise account – With CBiBank, this can be done fully online in just a few days.

Integrate with your business flow – Use the account details in contracts, invoices, and e-commerce platforms.

5. Mistakes to Avoid in Export Payment Collections

⚠️ Relying only on one software tool – Diversification reduces risk.

⚠️ Overlooking compliance requirements – This can result in payment delays or frozen accounts.

⚠️ Starting account setup too late – It’s better to have an account ready before you sign deals.

⚠️ Not aligning payment methods with buyers – Some clients prefer wire transfers, others e-commerce collections.

6. Practical Tips for Exporters

Use a bank account that combines software convenience with banking security.

Keep contracts clear about payment terms and methods.

Test payment flows with small amounts before scaling up.

Stay updated on currency policies in your buyer’s region.

FAQs on Payment Software in Foreign Trade

Q1: Can I use PayPal or similar apps for foreign trade?

They can work for small payments, but for large B2B transactions, an enterprise bank account is safer and more reliable.

Q2: How long does it take to open an enterprise account with CBiBank?

Usually between 1–3 working days, all handled online with video verification.

Q3: What currencies are supported?

Over 20 currencies, including USD, EUR, CNH, GBP, and JPY.

Q4: Does CBiBank support cross-border e-commerce sellers?

Yes, it supports platforms like Amazon, eBay, Wish, and Tmall Global.

Q5: Why not just use local banks?

Local banks may have stricter foreign exchange controls, while CBiBank offers more flexible fund transfers and fewer restrictions.

Conclusion

So, when asking “What payment software do exporters use in foreign trade?” the real answer is: exporters need more than just software—they need a trusted enterprise banking solution. With CBiBank, exporters can receive payments securely, in multiple currencies, and with the professional credibility that international trade demands.

Related articles

WeChat of CBiBank

WeChat of CBiBank